Restaurant Manager provides a set of reports to help audit sales and labor activity. Audit orientated reports will help you identify anomalies in ringing sales, timekeeping irregularities, aid in theft prevention,

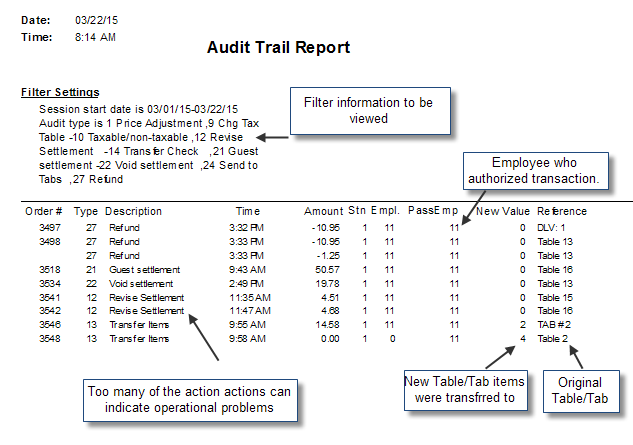

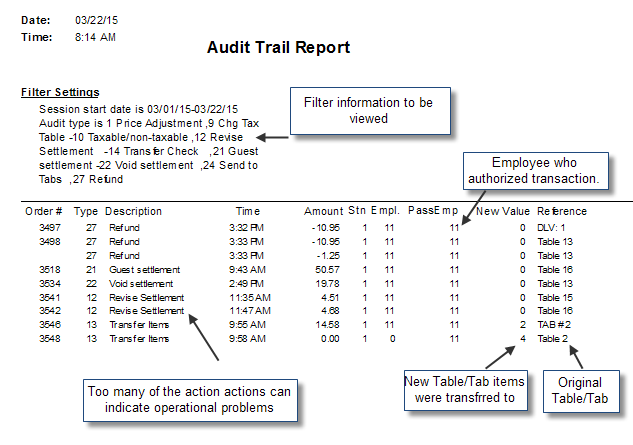

This important report allows you to track any time a manager (or other authorized employee) executes any sensitive operation such as refunding a check, revising a settled check, or transferring items/checks. The “Stn” column shows the station where the operation was executed. The “New Value” shows, if applicable, the resulting value of the operation performed.Example, on the last line of the sample report below, the we can see table 2 was transferred to table 4. The report , unfiltered has 27 different "Audit Types". You can filter this report to limit information displayed. This report is found under the Session Reports folder.

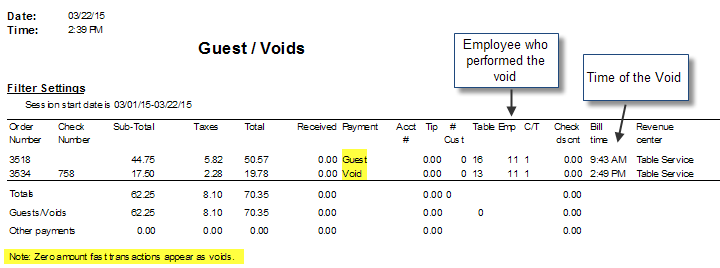

This report will tracks any transactions settled with the Void or Guest payment methods. In Restaurant Manager, Voids and Guest payment methods will negate an entire transaction like it never happened (but is still recorded by the system). Note: If your system is configured with the Inventory Module, you should note that voiding a check DOES NOT decrement inventory. If you wish to decrement inventory but recognize that no payment has been made, you must settle the check as a Guest (or “house”) check.

Tracking Guest or Void transactions will to you if employees are having procedural issues at the POS in the best case scenario. There are typically two reason for settling checks with these forms of payments: employee are messing up an order and it is easier to void the order and re-ring the transaction form scratch or an employee is being dishonest and are trying to erase their sales. It should be noted that fast transaction closed with a zero amount (i.e. exiting from a fast trans action at the POS) will be recorded as a Void.

The Guest Void Report will let you know what order was closed as a void, the dollar amount voided , where the void occurred and the employee who performed the void. This report gives the general details of transactions closed to Void and guest payments. The bottom sections of the Deleted Items report detail the specific items that were voided on the check. The Guest Void Report is found under the Session Reports folder.

Items removed from a guest check are referred to as deletions in the Restaurant Manager POS system. Item deletions can occur when an menu item has been added to a check, sent to a prep area, and then removed from a check when using the "Delete" function button at the POS. However, if your system is configured to log all deletions, then menu items will appear on this report whether they have been sent to a prep printer or not. In addition,menu items on guest checks closed to Guest or Void payment will also be logged as deletions.

The Deleted Items Report is an excellent tool to monitor menu items removed form guest and why. When configuring your system to prompt for a reason why a deletion is necessary, this report will help you determine if possible theft is occurring, if the kitchen is mis-preparing meals, if an employee is making service mistakes, or is having issues with ringing orders correctly. Once a pattern has been established, you can make an informed business decision to correct mistakes accordingly.

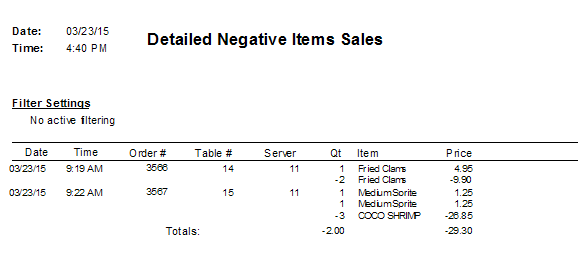

This report will detail all menu items on orders where negative quantity has been used. This report list the order number, employee who owns check, the negative quantity , item applied to, and total negative price.This report is found under the Session Reports folder.

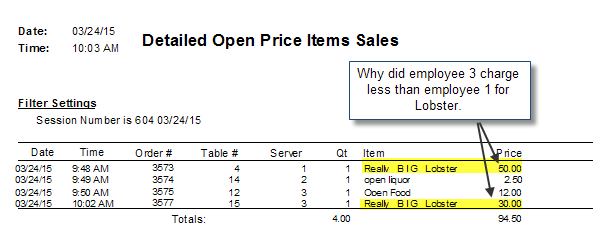

This report will displays all menu items programmed with the "Open Price" option enabled under the Price Options tab in the Menu Item Setup Form and has been added to a guest check. This report is an excellent tool to use to make sure employees are charging the correct price for a menu item as well as not abusing this function. In the sample report below, Lobster has been programmed for Open Price to accommodate for fluctuating market prices. A manager might question why employee 3 charged $20 less than employee 1 for Lobster. This report is found under the Session Reports folder.

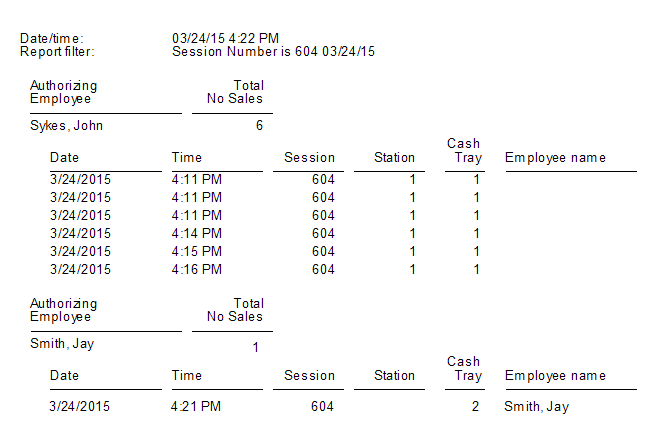

This report shows all the no sales cash drawer activity (cash drawer opened without an associated sale.) Note: employee name will only appear when a cash drawer has been assigned and linked to an employee.

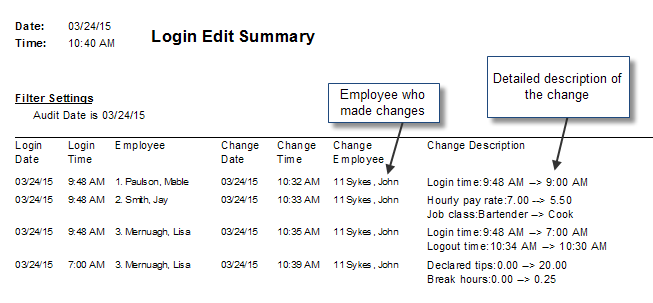

The Login Edit Summary Report will allow you to track any changes to employees time record made from the POS (Edit Login function button) or in the RM Back Office Module (Edit Login Data). The Change Description column shows both the original data and the new data entered. In the example report below we can see that Mable originally logged in at 9:48 AM but had her login time changed to 9:00 AM. This report will allow management to see if there are employees who have a problem clocking in, logging in with the correct job class, and to see if an employee might be gaming the system by padding hours for a friend or reducing hours to pad labor statistics to help earn a bonus. This report is found under the Labor reports folder.

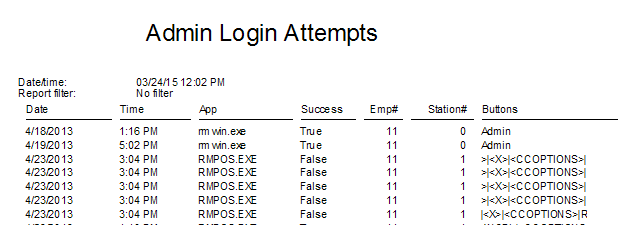

This is a PCI Mandatory report. This report shows any attempts to access any system function that could effect cardholder data. The App column list where the operation occurred (i.e. rmwin, rmccwin, or POS). The reports will log any button presses for the any PCI orientated administrative operations at the POS. This report is found under the Sessions Report folder.

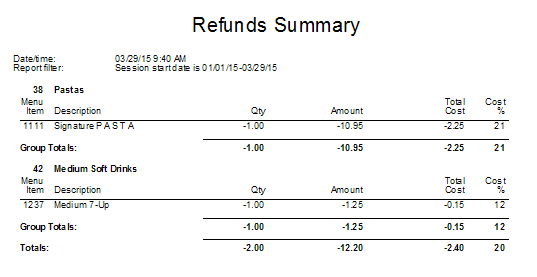

The Refund Summary report will show refunded menu items by menu group. The report is only populated by menu items refunded using the Refund function button at the POS. This report is especially useful to track refunds over a period of time to see if there is a pattern of menu items being refunded.This report is located in the Labor Reports folder.

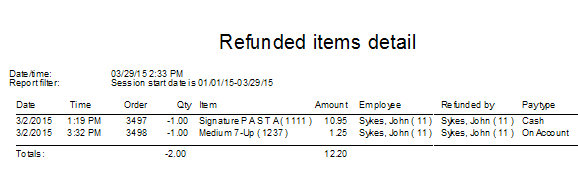

The Refund Items Detail report displays all menu items refunded for a given date range. This report details the refunded transaction by date, time, order #, employee password used to refund and the payment type. Use this report to determine if there is an employee who performs an excess amount of refunds (possible theft) , if there are days where excessive refunds occur, or use one of the "Sort by Filters" on the report to determine if there are specific items being constantly refunded. This report is located in the Labor Reports folder.

This report can tell you all items affecting cash due by an employee. The report will start with Cash receipts (cash sales including tax) and subtract or add the standard POS non sales functions (i.e. CC tip deduction, CC fees, money drops, etc). The report is broken into two sections: the top half will list cash handling details by employee, the bottom half is the sum total of all employees. This report can eliminate the need to review separate employee Revenue Reports when cash handling is your only concern. This report is found under the Labor Reports folder.

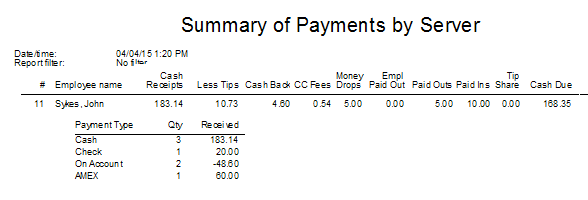

This report is similar to the Employee Cash Handling Report where it reports all items affecting cash due by an employee. The report will start with Cash receipts (cash sales including tax) and subtract or add the standard POS non sales functions (i.e. CC tip deduction, CC fees, money drops, etc). The difference in reports is that this report will all list all payment types including non cash. Note: the On Account line reflects the difference between Account Redeemed and Accounts Issued, In the sample report below there was an account redeemed for $1.40 and a Gift Card issue for $50.00 resulting in a negative $48.60 difference. This report can eliminate the need to review separate employee Revenue Reports when a summary of payments is your only concern.This report is found under the Labor Reports folder.

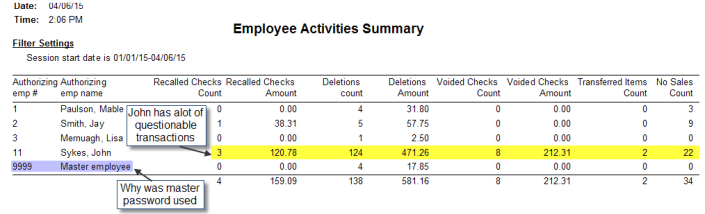

This report is an excellent tool to view at a glance the type of transactions associated with theft, improper order entry procedures, and operational mistakes. This report is found under the Labor Reports folder.