Last Topic: ADP Export Formats

Export Formats

The RMReports starting in RM February 2015 build provides a new report group named “ADPExport”. You will find the five export options The reports are detailed below.

ADP Payroll 1 Export

Some merchants can use the ADP to handle tipped jobs differently than non-tipped. If the merchant has configured their ADP system to do special calculations for tipped employees and the wish to specify which jobs are tipped and which are not, they can use ADP Payroll 1. This option should be used only if the customer has consulted with ADP to do the special tax calculations.. Note: the Payroll 1 export does not include gratuities as wages.

Unless there is a specific requirement to specify special hours codes for tipped employees it is recommended that the merchant use the ADP Payroll 2 format.

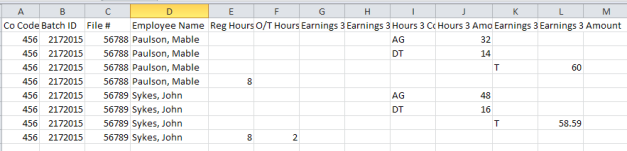

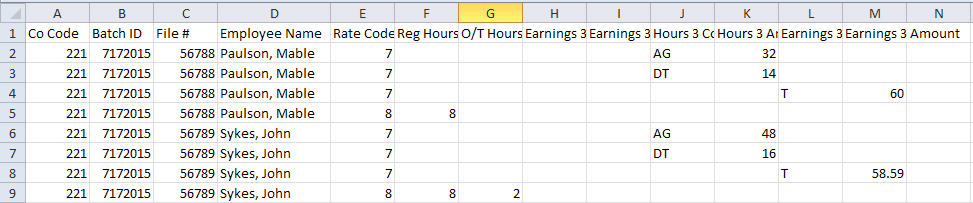

The ADP Report 1 is broken down into the following:

- CO Code (Column 1) –This is a unique 3 character company code supplied by ADP. The Co Code is configured in The Store Info Setup form.

- Batch ID (Column 2)- Generated at report time. This is a date stamp automatically generated by the reporting engine mm/dd/yy (Length = 8). No setup required

- File number (Column 3)- This is a unique employee identifier, The employee identifier is configured in the Employee Setup form..

- Employee Name (Column 4)- The employee name associated with the File number No setup required

- Regular Hours (Column 5)- Regular Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- OT Hours (Column 7)- Overtime Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- Earning Code 3 (7th Column)- This column does not populate and is reserved for future use.

- Earnings 3 Amount (8th Column)- This column does not populate and is reserved for future use.

- Hours 3 Code (9th Column)-The code that appears in this column is configured in the Job Classification form setting "Tipped job regular hours code" and "Tipped job overtime hours code"

- Hours 3 Amount (10th Column)- the total hours for a time period. This can be either regular or overtime hours and is designated as such using the Hours 3 Code.

- Earnings 3 Code (11th Column)- The "T" in this column auto populates and indicates the next column will be the total amount of Non-cash and declared tips. That code is not currently configurable in Restaurant Manager but the ADP side can be changed to match.

- Earning 3 Amount (12th Column)-This column only populates when "Tipped job" setting not enabled for a job class. The amount in this column represents the sum of declared tips and cc tips. Restaurants should ensure that when tipped employees are declaring tips on the POS (usually at logout) they are declaring ONLY the cash tips received over and above credit card tips. The system will automatically declare the non-cash tips and add it to the declared tips. So for example, if an employee is leaving with $100 in total tips, but $75 of that was from credit card tips entered into the POS system they should declared ONLY $25 on the POS.

Note: Tips will appear on a separate line

ADP Report 1 Sample

ADP Report 1 CSV Format Sample

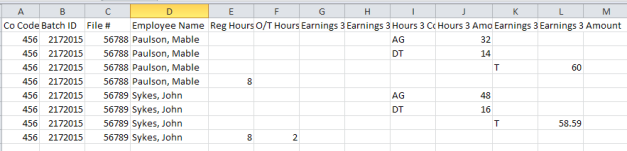

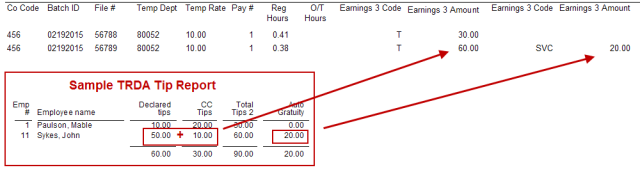

ADP Payroll 2 Export

A specific advantage of the ADP Payroll 2 format is that each record includes a field for the job worked and the pay rate for that specific job. Every time a report is generated, the current pay rate for that employee/job will also pass across in the export. It is important that the end user times carefully any adjustments in pay and when they run the report to ensure the pay rate on the report is what the employee should be paid for the specified report period. Pay Rate information is NOT in format 1, so the end user must adjust pay rates on the ADP side for each employee.

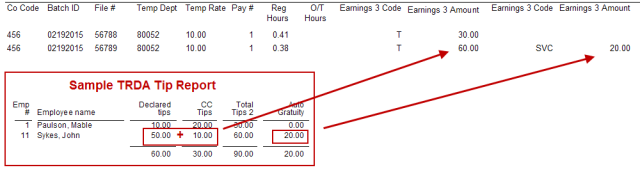

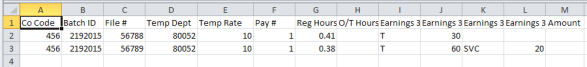

The ADP Report 2 is broken down into the following:

- Co Code (Column 1)- This is a unique 3 character company code supplied by ADP. The Co Code is configured in The Store Info Setup form.

- Batch ID (Column 2)- This is a date stamp automatically generated by the reporting engine. No setup required

- File # (Column 3)- This is a unique employee identifier, The employee identifier is configured in the Employee Setup form.

- Temp Dept (Column 4)- This identifies the job worked. The Temp Dept is configured in the Job Classification Setup form (ADP Department field).

- Temp Rate (Column 5)- This is the pay rate for the job worked, from the normal employee hourly rate

- Pay # (Column 6)- This will always be 1 and is generated automatically at run-time.. No setup required

- Reg Hours (Column 7)- Regular (Non-overtime) hours for the pay period. No setup required.

- O/T Hours (Column 8)- Overtime Hours for the pay period. No setup required.

- Earnings 3 Code (Column 9- The "T" in this column auto populates and indicates the next column will be the total amount of Non-cash AND declared tips. That code is not currently configurable in Restaurant Manager but the ADP side can be changed to match.

- Earnings 3 amount (Column 10) - This field is auto populated . The amount in this column represents the sum of declared tips and cc tips. Restaurants should ensure that when tipped employees are declaring tips on the POS (usually at logout) they are declaring ONLY the cash tips received over and above credit card tips. The system will automatically declare the non-cash tips and add it to the declared tips. So for example, if an employee is leaving with $100 in total tips, but $75 of that was from credit card tips entered into the POS system they should declared ONLY $25 on the POS.

- Earnings 3 Code (Column 11)- This is the code to indicate auto gratuities will be specified in the next column.. It must be the same code in ADP if the site is using auto gratuities in payroll. The code found in this column is Auto gratuity Code.Company ID is configured in the Store Info Setup form under the "Other" tab.The report image below uses SVC as the code.

- Earnings 3 Amount (Column 12)- This is the auto-gratuity amount reported by the POS. No setup required

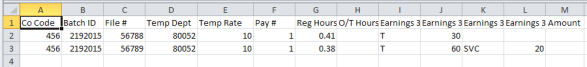

Sample Report 2

Sample Report 2 CSV Format

ADP Payroll 3 Export

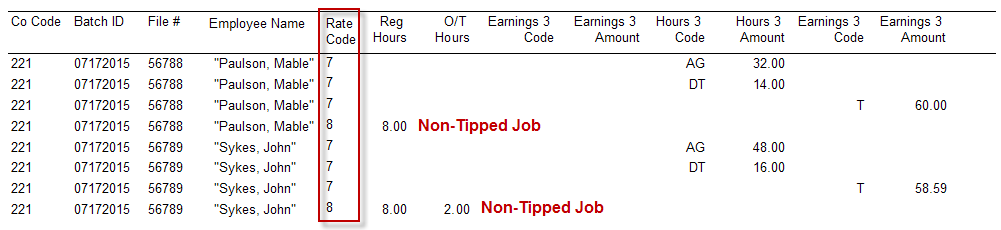

The ADP Report 3 is broken down into the following:

- CO Code (Column 1) –This is a unique 3 character company code supplied by ADP. The Co Code is configured in The Store Info Setup form.

- Batch ID (Column 2)- Generated at report time. This is a date stamp automatically generated by the reporting engine mm/dd/yy (Length = 8). No setup required

- File number (Column 3)- This is a unique employee identifier, The employee identifier is configured in the Employee Setup form..

- Employee Name (Column 4)- The employee name associated with the File number No setup required

- Rate Code (Column 5 - The rate code determined by the Rate Code field in Job Classifications Setup Form

- Regular Hours (Column 6)- Regular Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- OT Hours (Column 7)- Overtime Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- Earning Code 3 (8th Column)- This column does not populate and is reserved for future use.

- Earnings 3 Amount (9th Column)- This column does not populate and is reserved for future use.

- Hours 3 Code (10th Column)-The code that appears in this column is configured in the Job Classification form setting "Tipped job regular hours code" and "Tipped job overtime hours code"

- Hours 3 Amount (11th Column)- the total hours for a time period. This can be either regular or overtime hours and is designated as such using the Hours 3 Code.

- Earnings 3 Code (12th Column)- The "T" in this column auto populates and indicates the next column will be the total amount of Non-cash and declared tips. That code is not currently configurable in Restaurant Manager but the ADP side can be changed to match.

- Earning 3 Amount (13th Column)-This column only populates when "Tipped job" setting not enabled for a job class. The amount in this column represents the sum of declared tips and cc tips. Restaurants should ensure that when tipped employees are declaring tips on the POS (usually at logout) they are declaring ONLY the cash tips received over and above credit card tips. The system will automatically declare the non-cash tips and add it to the declared tips. So for example, if an employee is leaving with $100 in total tips, but $75 of that was from credit card tips entered into the POS system they should declared ONLY $25 on the POS.

Note: Tips will appear on a separate line

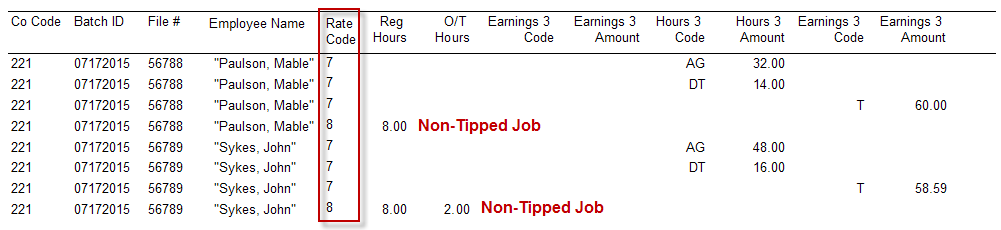

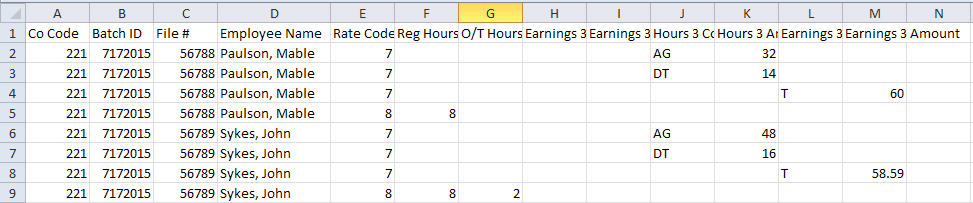

Sample Report 3

Sample Report 3 CSV Format

ADP Payroll 4 Export

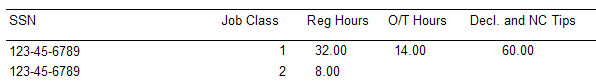

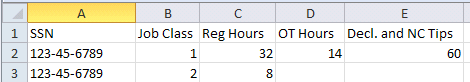

The ADP Report 4 is broken down into the following:

- SSN (Column 1) - Employee.DBF>EMPL_TXT1

- Job Class (Column 2) - Jobclass.DBF>JOB_NO

- Reg Hours (Column 3) - Regular Hours Worked

- OT Hours (Column 4) - Over time Hours

- Decl. and NC Tips (Column 5) - a sum of declared and non-cash tips

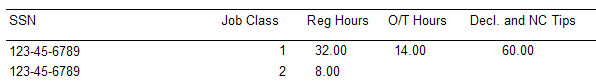

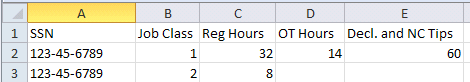

Sample Report 4

Sample Report 4 CSV Format

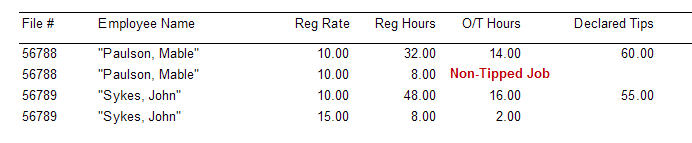

ADP Payroll 5 Export

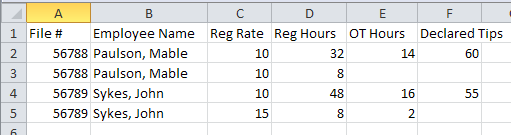

This report breaks down as follows:

- File number (Column 1)- This is a unique employee identifier, The employee identifier is configured in the Employee Setup form..

- Employee Name (Column 2)- The employee name associated with the File number No setup required

- Reg Rate (Column 3)- This is the pay rate for the job worked, from the normal employee hourly rate

- Regular Hours (Column 4)- Regular Hours Employee worked for defined time period. Column populates on separate rows for tipped and non tipped jobs.

- OT Hours Column 4 -Column populates Over time Hours on separate rows for tipped and non tipped jobs.

- Decl. and NC Tips Column 5 - a sum of declared and non-cash tips

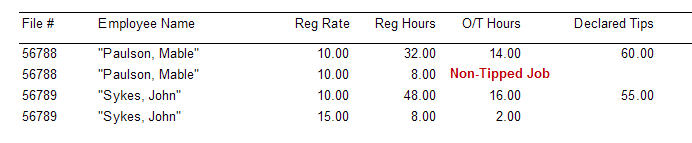

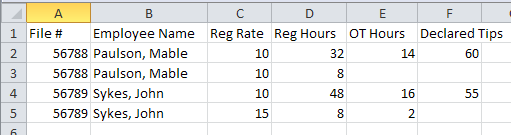

Sample Report 5

Sample Report 5 CSV Format

ADP Payroll 6 Export

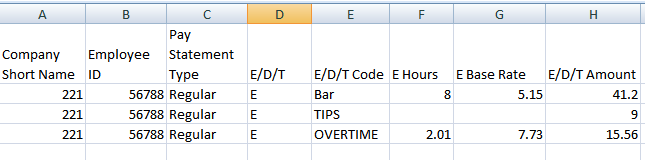

The ADP Report 6 is broken down into the following:

Company Short Name (Column 1) - This is a unique 3 character company code supplied by ADP. The Co Code is configured in The Store Info Setup form.

Employee ID (Column 2) - This is a unique employee identifier, The employee identifier is configured in the Employee Setup form.

Pay Statement Type (Column 3) - This column is hard coded and will always be EARNINGS

E/D/T (Column 4) - This column is hard coded and will always be "E" (as in earnings)

E/D/T Code (Column 5) - This will be either a Jobclass name or TIPS (decl & non-cash), or OVERTIME.

E Hours (Column 6) - This line will represent regular hours worked for a Jobclass

E Base Rate (Column 7) - This is the pay rate for the employee Jobclass worked for this line

E/D/T Amount (Column 8) - This will be the total earnings or total tips

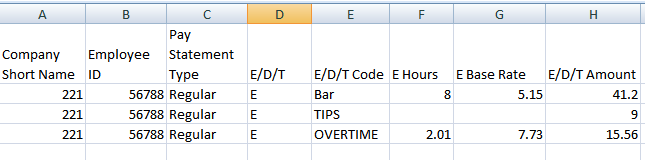

Sample Report 6

Sample Report 6 CSV Format

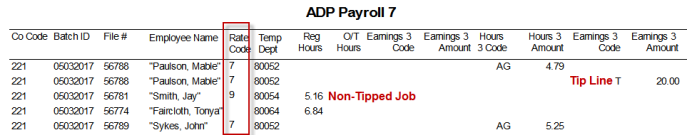

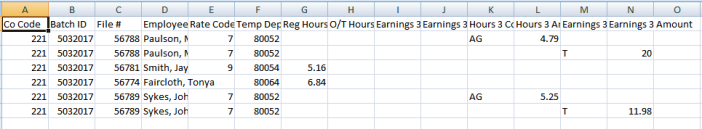

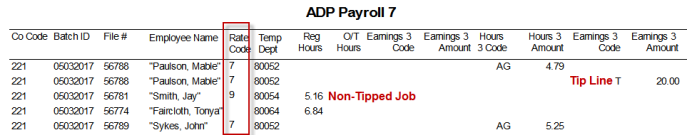

ADP Payroll 7 Export

The ADP Report 7 is broken down into the following:

- CO Code (Column 1) –This is a unique 3 character company code supplied by ADP. The Co Code is configured in The Store Info Setup form.

- Batch ID (Column 2)- Generated at report time. This is a date stamp automatically generated by the reporting engine mm/dd/yy (Length = 8). No setup required

- File number (Column 3)- This is a unique employee identifier, The employee identifier is configured in the Employee Setup form..

- Employee Name (Column 4)- The employee name associated with the File number No setup required

- Rate Code (Column 5 - The rate code determined by the Rate Code field in Job Classifications Setup Form

- Temp Dept (Column 6) - This identifies the job worked. The Temp Dept is configured in the Job Classification Setup form (ADP Department field).

- Regular Hours (Column 7)- Regular Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- OT Hours (Column 8)- Overtime Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- Earning Code 3 ( Column 9)- This column does not populate and is reserved for future use.

- Earnings 3 Amount (Column 10)- This column does not populate and is reserved for future use.

- Hours 3 Code (Column 11)-The code that appears in this column is configured in the Job Classification form setting "Tipped job regular hours code" and "Tipped job overtime hours code"

- Hours 3 Amount (Column 12)- the total hours for a time period. This can be either regular or overtime hours and is designated as such using the Hours 3 Code.

- Earnings 3 Code (Column 13)- The "T" in this column auto populates and indicates the next column will be the total amount of Non-cash and declared tips. That code is not currently configurable in Restaurant Manager but the ADP side can be changed to match.

- Earning 3 Amount ( Column 14)-This column only populates when "Tipped job" setting not enabled for a job class. The amount in this column represents the sum of declared tips and cc tips. Restaurants should ensure that when tipped employees are declaring tips on the POS (usually at logout) they are declaring ONLY the cash tips received over and above credit card tips. The system will automatically declare the non-cash tips and add it to the declared tips. So for example, if an employee is leaving with $100 in total tips, but $75 of that was from credit card tips entered into the POS system they should declared ONLY $25 on the POS.

Note: Tips will appear on a separate line

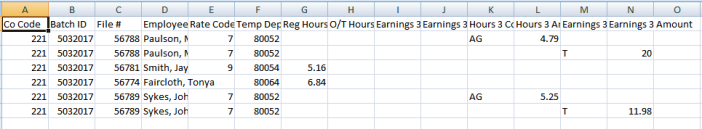

Sample Report 7

Sample Report 7 CSV Format

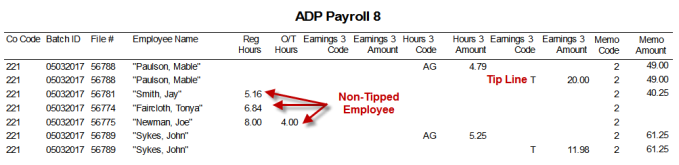

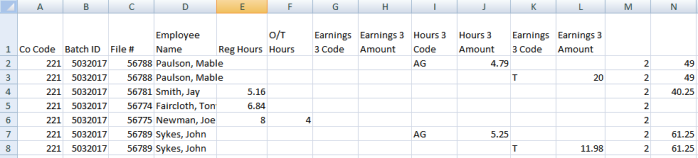

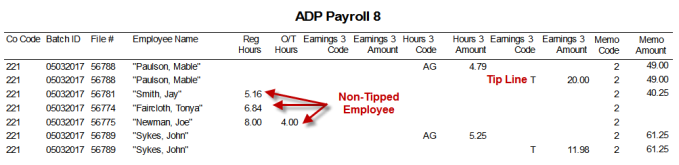

ADP Payroll 8 Export

The ADP Report 8 is broken down into the following:

CO Code (Column 1) –This is a unique 3 character company code supplied by ADP. The Co Code is configured in The Store Info Setup form.- Batch ID (Column 2)- Generated at report time. This is a date stamp automatically generated by the reporting engine mm/dd/yy (Length = 8). No setup required

- File number (Column 3)- This is a unique employee identifier, The employee identifier is configured in the Employee Setup form.

- Employee Name (Column 4)- The employee name associated with the File number No setup required.

- Regular Hours (Column 5)- Regular Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- OT Hours (Column 6)- Overtime Hours Employee worked for defined time period. Column populates only when "Tipped job" setting not enabled for a job class.

- Earning Code 3 ( Column 7)- This column does not populate and is reserved for future use.

- Earnings 3 Amount (Column 8)- This column does not populate and is reserved for future use.

- Hours 3 Code (Column 9)-The code that appears in this column is configured in the Job Classification form setting "Tipped job regular hours code" and "Tipped job overtime hours code"

- Hours 3 Amount (Column 10)- the total hours for a time period. This can be either regular or overtime hours and is designated as such using the Hours 3 Code.

- Earnings 3 Code (Column 11)- The "T" in this column auto populates and indicates the next column will be the total amount of Non-cash and declared tips. That code is not currently configurable in Restaurant Manager but the ADP side can be changed to match.

- Earning 3 Amount ( Column 12)-This column only populates when "Tipped job" setting not enabled for a job class. The amount in this column represents the sum of declared tips and cc tips. Restaurants should ensure that when tipped employees are declaring tips on the POS (usually at logout) they are declaring ONLY the cash tips received over and above credit card tips. The system will automatically declare the non-cash tips and add it to the declared tips. So for example, if an employee is leaving with $100 in total tips, but $75 of that was from credit card tips entered into the POS system they should declared ONLY $25 on the POS.

- Memo Code (Column 13 - This is a hard coded number that cannot be changed.

- Memo Amount (Column 14) - This field will show pre-tax sales.

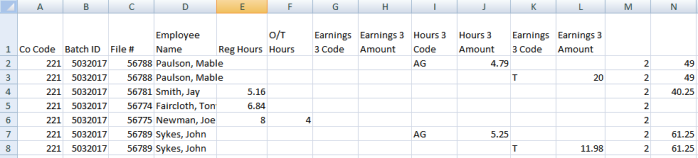

Sample Report 8

Sample Report 8 CSV Format

Note: Tips will appear on a separate line

Next Topic: Generate ADP Export